Whether you’re a first-time homebuyer who’s currently renting, or a homeowner looking to move up or downsize, the first thing you should do before making any other decisions is checking your credit rating.

Get your credit report and review it. Go to annualcreditreport.com, the only source for free credit reports authorized by federal law. In the past, you could get one free report a year from each of the three major credit bureaus. Right now, those three bureaus are offering free reports weekly through April 2022.

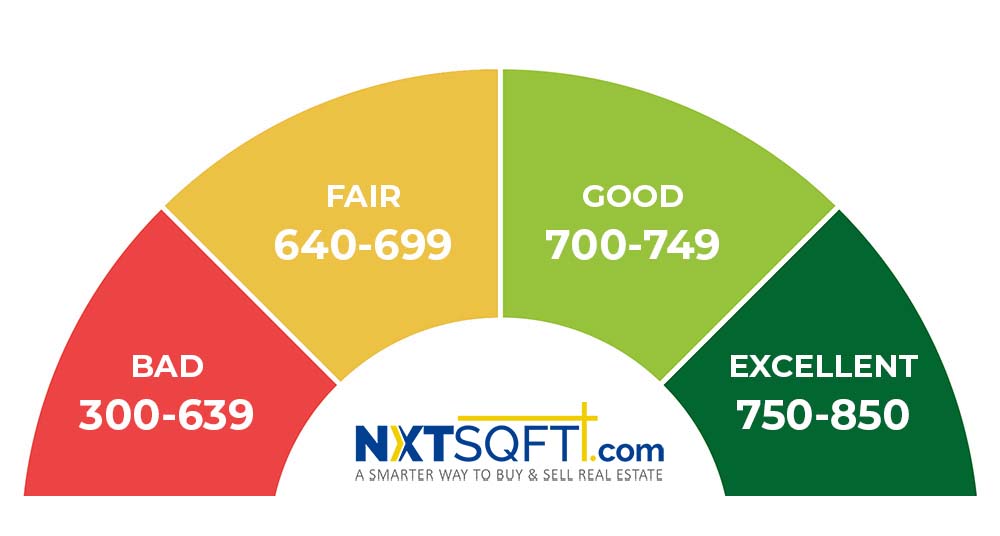

Understand what your credit report represents and review it. A credit report is a record of how well you have met your financial obligations over time. You do not have to be wealthy to have good credit. Instead, you need to pay off your debt consistently and on time. Your credit report also shows your credit score, from 300 to 850, based on your credit report. Lenders use this score to determine your viability as a borrower. If you find an error on your credit report, contact the credit bureau to have it resolved.

Know how your credit report affects the home buying process. Your credit rating helps determine the size of the mortgage you’re eligible for, the type of mortgage, the down payment amount, and any additional private mortgage costs. These factors will impact your overall housing budget.

Talk to your lender. Tell your mortgage broker or loan officer the size of the monthly payment you are comfortable with. If you would like a smaller monthly payment, consider a longer-term loan. If there are gaps in your credit report, inform the lender of the reason, such as an emergency expense or a layoff.

Work to strengthen and maintain your credit. To keep your credit score as high as possible, or to rebuild it if it is currently low, pay your bills each month on time. Make the monthly payment specified in the terms of your car, student, or another loan. You do not need to pay your credit card bill in full every month, but do be sure to at least pay the minimum payment. Missing a payment could seriously affect your credit rating. If your credit report is thin on activity, ask lenders whether they will accept a statement of your rent payments as additional evidence of your creditworthiness. Here’s more on how to possibly improve your credit score.

Thinking of selling or buying a home? Please text, call, or email us to learn about your best options today!